Real Estate Solutions

Buying Real Estate

Buying a home is a significant and exciting decision. This section provides professional real estate advice and helpful home buying tips.

First Steps

Determine your “non-negotiables”. What are those things that you require in a home?

- Neighborhoods

- Schools

- # of Garage Bays

- One Story, Two Story.....

- Managed Association

Determining Your Budget

It is often very difficult to become satisfied with your selection if you start off perusing homes beyond your price range. Your local banker can help you determine your loan qualification criteria and put you in a better negotiating position by pre-qualifying you for a loan. A Team Catalyst agent can help point you in the right direction to finding a suitable lender or mortgage specialist.

Your credit score will greatly impact your buying power. Plan ahead and manage expectations. With lower scores comes higher interest rate pricing and monthly payments.

Selecting a Home

Buying a home is a big commitment but remember it is often not the only home you will purchase in your lifetime. Your needs may change as you age. Planning for a home that serves your 5-10 year needs is a reasonable consideration.

The internet is a great tool for seeing what is available in your market area. Once you have determined your interests, a Team Catalyst agent will schedule a tour to see your top picks.

Once you are ready, a Team Catalyst agent will guide you through the process of determining an appropriate amount to offer.

Beyond Closing

What happens after you close on your house? Century21.com continues to provide guidance after the sale is completed.

Inspection

Home inspection is an important step in the buying process. A typical inspection costs between $400-$600.

Hire a professional home inspector to give the house a standard inspection that includes:

- Room-by-room inspection

- Drywall cracking

- Termite damages

- Failed window seals that cause the window pane to fog and lose efficiency

- Leaking faucets

- Toilet functioning

- Electrical components, wall outlet grounding, faulty breakers

- Exterior home components

- Foundation and structural components – both interior and exterior

- Heating and air conditioning systems efficiency, operations, ductwork leaks, and drain lines; electrical components, wall outlet grounding, and faulty breakers

- Plumbing systems

- Attic spaces, leaks, electrical connections, insulation, poor ventilation, roof leaks, and defects from aging

- Maintenance problems such as rotting decks, paint chips, water damaged ceilings, etc.

- Drainage problems, which could include water intrusions below the home

- Excess air leakage due to poor weather stripping, building movement, and/or poor sealant around penetrations

- Environmental contamination caused by asbestos, mold, formaldehyde, lead paint, radon, soil contamination, and/or water contamination

- Faulty lines in water heaters, overflow piping, and/or hazardous flue conditions

Insurance

Team Catalyst agents can assist you in selecting an insurance agent. Your lender will determine the minimum deductible and required coverage.

Timeline and Paperwork

In the home buying process, ownership of the home is officially transferred to you at the closing meeting. Agree in advance that the home will be vacant at the time of closing or make arrangements for a leaseback if additional time is needed for the seller to vacate the premises. However, it is recommended that the buyer demand the home be vacated and inspected before closing.

Moving In

At least 30-45 days prior to the move, it is time to find a mover, solicit friends, and rent moving equipment. Keep in mind that the specific day, week, and month you choose will affect the cost of your move. Moving during peak season (June to September) will likely cost more. The same goes for weekend moves.

Rent a Home

Team Catalyst agents will assist with pre-qualifying you for your home and will provide you a list of available rentals and pricing.

Keep in mind that your lease agreement is a binding legal document, and failure to fulfill your lease obligations can result in derogatory credit reporting and collections of unpaid rent.

"Our team handles your property in all respects"

Trusted, Comprehensive Rental Management Services

Owning a rental property is a great investment, but handling it can be complex. Catalyst Property Solutions offers comprehensive rental management services you can trust.

Our team handles your property in all respects, saving you time, money, and stress along the way. We take care of all communication with current and prospective residents alike, including new tenant screening, marketing your property, handling leasing contracts and documents, collecting rent, and managing tenant issues.

We're there to mitigate maintenance and repair problems, and we supply convenient online tenant and owner portals. Learn more about our rental management services when you contact us today.

Need a Property Manager?

Contact Us

Renovations and Maintenance Solutions

Our Blue Marlin Maintenance and Service Team provides in-house repair service at below industry pricing, saving our clients money on all facets of property maintenance.

Learn MoreDue Diligence

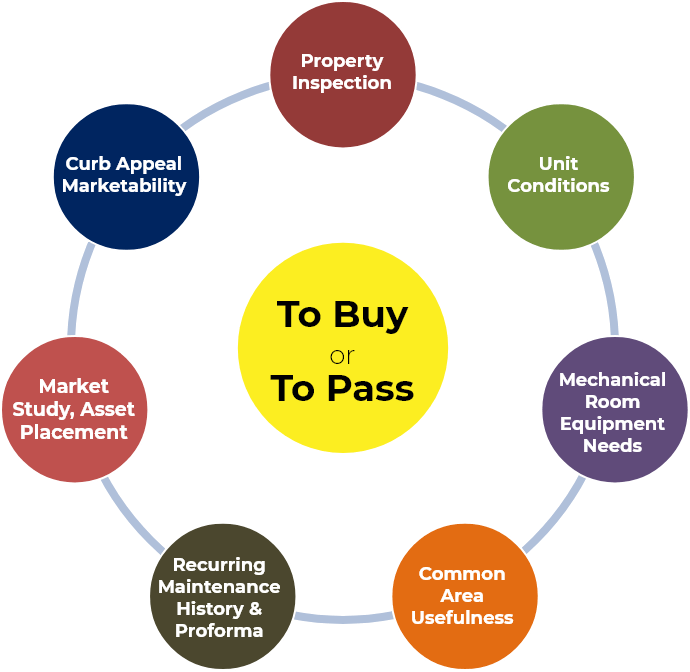

Due diligence is the investigation that a reasonable business or person should take before entering into a purchase contract.

Our due diligence process is outlined below:

- Property inspection, including touring all residential units, mechanical rooms, common areas, and grounds.

- Evaluating the maintenance history and looking for recurring concerns.

- Market Analysis Study of utility consumptions and provider options.

- Conducting random tenant interviews.

- Analyzing former operating performance of assets.

- Reviewing the financial proforma with you.

- Collaborating with a business blueprint as you assess the probability of success.

- Single Family – Worked with some 1000 foreign investors who overpaid for properties purchased in Florida and Texas, including houses and condominiums, to improve the values and rental rates under very unfortunate circumstances. Their Chinese agent sold these properties as all-cash purchases without property inspections or appraisals to later find the properties were not consistent with the photographs presented, the rental market, or the operating expense proformas they were provided.

- Rolled out the software so that each owner could have an exclusive owner’s portal to provide transparency across the globe, including monitoring tenant work order requests, vendor invoices, and providing on-line data storage for clients.

- Hired Mandarin and Cantonese speaking accountants to improve the American manager to Chinese client communications.

Team Catalyst will provide guidance within the multiple layers of negotiating the application, managing the due diligence, handling the closing, sourcing the loan with our very dedicated mortgage broker, sourcing insurance options with our reputable insurance broker, and servicing the lender relationship as Team Catalyst.